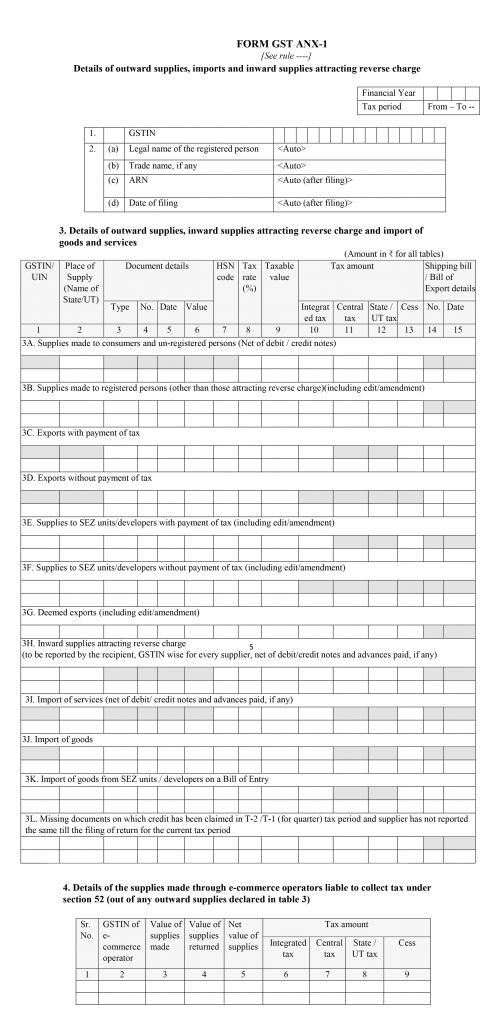

FORM GST ANX-1 is an annexure to the main return GST RET-1 introduced under the new filing system of simplified returns under GST. This annexure will contain details of all outward supplies, inward supplies liable to reverse charge and import of goods and services. Details in this annexure will have to be reported invoice-wise (except for B2C supplies) based on continuous uploading facility to be made available onGST portal. The reporting can be done on a real-time basis, and will be available for the recipient of supplies to take necessary action in their FORM GST ANX-2.

A taxpayer needs to input the GSTIN and the basic details such as trade name, legal name, etc. will be auto-populated on the basis of the GSTIN.

Details of outward supplies, inward supplies attracting reverse charge and import of goods and services: The details will be entered as follows-

Table No. | Name of the Table | Instructions | Notes |

3A | Supplies made to consumers and unregistered persons (Net ofdebit/credit notes) | All supplies that have been made to consumers and unregistered persons (i.e. B2C) need to be reported here. | The supplies need to be reported in a summary form tax rate wise and net of debit/credit notes. HSN Codes are not required to be reported here. |

3B | Supplies made to registered persons (other than those attracting reverse charge) | All supplies (other than those which attract reverse charge) that have been made to registered persons (i.e. B2B) need to be reported here. Reporting of supplies made to entities (including Government departments) having a TDS or TCS registration need to be also reported here. This would also include amendments, if any. | Only the supply of services (NOT goods) made by an SEZ to a person located in a domestic tariff area (DTA) needs to be reported here. The supply of goods by an SEZ to a person located in the DTA shall be reported in table 3K. The supply of goods or services made TO an SEZ unit shall not be reported here, but reported in table 3E or 3F, as the case may be. The ‘invoice value’ needs to be reported in column 6 and the ‘taxable value’ in column 9. For ex: If the taxable value is Rs 200, the tax at 18% will be Rs 36, hence the total invoice value will be Rs 236. |

3C & 3D | Exports with/without payment of tax | All exports with payment of tax (i.e. Integrated tax or IGST) need to be reported in table 3C, while exports without payment of tax need to be reported in table 3D. | The shipping bill number / bill of export number that is currently available as on the date of filing of return needs to be reported against the export invoices. The details of the remaining shipping bills can be reported after filing of the return. A separate functionality for updating details in table 3C 3D will be made available on the portal. |

3E & 3F | Supplies to SEZ units/developers with/without payment of tax | All supplies made to SEZ units / developers with payment of tax need to be reported in table 3E, and supplies made without payment of tax need to be reported in table 3F. This includes amendments, if any. | For supplies made with the payment of tax, the supplier will have an option to select if either he will claim refund on such supplies or the SEZ unit. The SEZ unit is eligible to availinput tax creditand claim a refund on unutilised credit after export, ONLY if the supplier is not availing such refund. |

3G | Deemed exports | All supplies treated as deemed exports need to be reported here. This would include amendments, if any. | The supplier has the option to declare if the refund will be claimed by him, or the recipient of deemed export supplies. If the refund is claimed by the supplier, then the recipient will not be eligible to avail input tax credit on such supplies. |

3H | Inward supplies attracting reverse charge (to be reported by the recipient, GSTIN wise for every supplier, net of debit/credit notes and advances paid, if any) | All inward supplies which attract reverse charge need to be reported here by the recipient. The details have to be reported GSTIN-wise and not invoice-wise. | Advances paid on such supplies shall be declared in the month in which the advance was paid. The value of supplies reported shall be net of the following: debit/credit notes, and -advances on which tax has already been paid at the time of payment of advance, if any. If only an advance has been paid to the supplier, and no invoice or supply received, then on reporting the same, this credit shall reflect in the main return (FORM GST RET-1), but needs to be reversed in table 4 of the said return. This credit can be availed only on receipt of the supply and issue of invoice by the supplier. |

3I | Import of services (net of debit/ credit notes and advances paid, if any) | Services which have been imported need to be reported here. | The value of supplies needs to reported net of debit / credit notes, and advances paid, on which tax has already been paid at the time of payment of advance. The amount of advance paid needs to be declared in the month in which the same was paid. Details are not required to be reported invoice-wise in this table. Services received from SEZ units / developers shall not be reported in this table. If only an advance has been paid to the supplier, and no invoice or supply received, then on reporting the same, this credit shall reflect in the main return (FORM GST RET-1), but needs to be reversed in table 4 of the said return. This credit can be availed only on receipt of the supply and issue of invoice by the supplier. |

3J | Import of goods | The details of taxes paid on the import of goods need to be reported here.

These goods were subjected to IGST at the time of import, and are hence not subjected to tax once again while filing this return. The amount of IGST and cess paid at the port of import needs to be reported here, in order to avail input tax credit. | Any reversal done due to ineligibility of credit or otherwise is to be carried out in table 4B of the main return (FORM GST RET-1). |

3K | Import of goods from SEZ units / developers on a Bill of Entry | Goods received from SEZ units / developers on a Bill of Entry need to be reported here by the recipient.

These goods were subjected to IGST at the time of clearance into the DTA, and are hence not subjected to tax once again while filing this return. | The SEZ unit making such supplies should not include such outward supplies in table 3B. The reporting in table 3J and 3K shall be required till such time the data from ICEGATE and SEZ to GSTN system starts flowing online. |

3L | Missing documents on which credit has been claimed in T-2 /T-1 (for quarter) tax period and supplier has not reported the same till the filing of return for the current tax period | The recipient needs to provide document-wise details of the supplies for which credit has been claimed but the details of supplies are yet to be uploaded by the supplier(s) concerned as detailed below:

(i) Where the supplier has not reported supplies even after a lapse of two tax periods in the case of monthly return filers and after a lapse of one tax period in the case of quarterly return filers.

(ii) Where the supplier uploads the invoice after the recipient reports the same in this table, then such credit needs to be reversed by the recipient in table 4B(3) of the main return (FORM GST RET-1) as this credit cannot be availed twice. | |

4 | Details of the supplies made through e-commerce operators liable to collect tax under section 52 (out of any outward supplies declared in table 3) | All supplies made through e-commerce operators liable to collect tax under section 52 shall be reported here at a consolidated-level in this table even though these supplies have already been reported in table 3. |