GST revolutionised the way the country does business. GST being a transaction based consumption tax, it is essential for every business to effectively and accurately compute and record the GST component of their transactions. Effective management of the GST data also makes life easier when it is time to file GST returns. If you find that getting your head around the calculation and filing of GST is just too time consuming, a GST software that is part of a financial and business management software makes work easier. It keeps track of all your financial and GST information in an integrated manner. GST software with financial accounting is a single solution for all your different accounting needs.

AGST softwareis your one-stop-shop for all your compliance needs. From raising invoices to managing your inward and outward supplies, GST software enables you to keep your books of record up-to-date at all times seamlessly.Tally Prime Ensures that your GST returns are in sync with your books of accounts, and reflect the same data as used for filing returns in the GST portal, thus proving to be the right GST return software for you. With Tally Prime you can generate GST reports required for filing with a few clicks. Tally Prime also helps you manage the purchase, inventory and sales aspects of your business. It is a complete business management software with state of the art financial accounting features.

Every country’s government depends on taxes to generate money. This money is used to maintain and develop the country. The government can only run, maintain infrastructure and take care of its people through welfare schemes and incentives when it has enough funds. Hence, it is the duty of every citizen to pay their taxes in order to keep the government functioning for their benefit. Filing your GST returns on time and with complete accuracy is essential for compliance and as your duty to your government.

There are two types of taxes that the government collects; direct and indirect taxes.

As the name indicates this type of tax is levied directly on the income of people and business entities. It is very important to the government as it makes up a large component of the government’s tax revenues. Direct taxes are paid directly by the individual or business to the government. The tax levied is proportional to the income earned by the person or entity.

The lowest income groups are usually exempted from paying tax. This ensures that there is economic and social equality in the collection of taxes from the people.

Indirect taxes are the taxes that the citizens pay when they sell or purchase goods or services.

Indirect forms of taxes are not directly imposed on a taxpayer’s income, but indirectly when they avail or purchase goods and services. It is an easy way to collect taxes from all the people in the country including those who do not pay direct taxes.

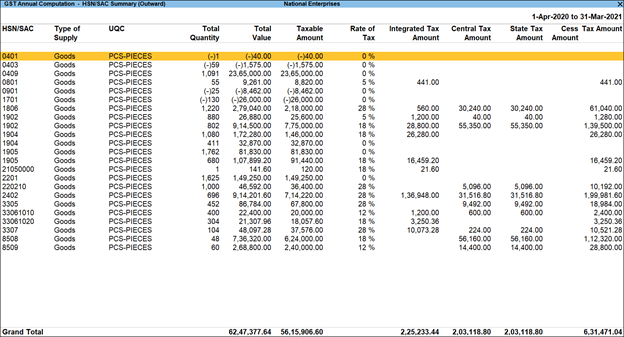

Tally Prime HSN/SAC Summary of Outward Supplies

One of the goals of GST as described above is to digitise the process of taxation to make it easier to do business. When taxes can be filed and paid digitally, it makes good sense to also manage all the financial transactions of businesses digitally. When you use an intelligent business management software that computes GST for every applicable transaction, financial accounting for taxes becomes easier. A GST software also makes the extraction of GST reports and invoices easy and ensures compliance. You can very easily generate the relevant reports and file your taxes on time through the year. Filing your GST returns in a digital format is effortless with GST software.

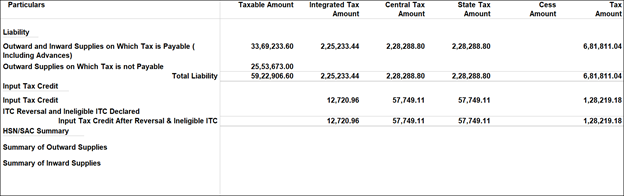

GST Liability, Input Credit, and HSN/SAC Summary In Tally

A good GST software should make every step of managing and filing your taxes effortless. Some of the features to look for in a good GST software are:

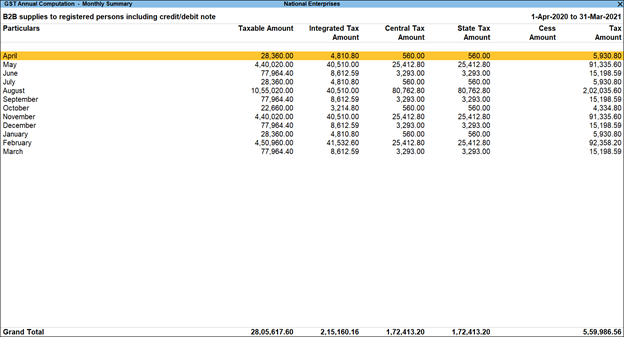

Month-wise Breakup Of GST

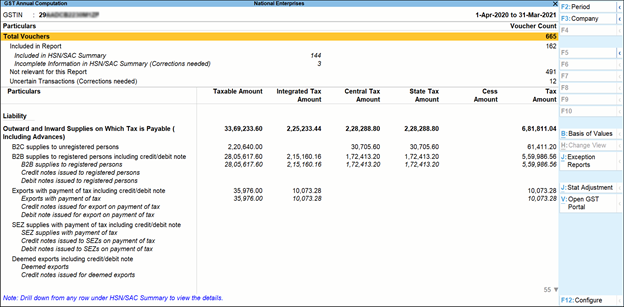

GST Annual Report In Tally Prime

Tally Prime is undoubtedly the best GST software in India because of its extensive features:

So, make your business management digital and enjoy the benefits of accuracy, increased productivity and ease of use with Tally Prime. It gives you a single solution for all your accounting, inventory and sales needs and manages GST seamlessly across all applicable transactions. It keeps your financial accounting and GST details up-to-date in real time. Filing GST details accurately and promptly is simple and straightforward with Tally Prime.