It’s that time of the year again, the business owners alongside their financial team hustle and bustle around to get their books and financial statements right. Yes, you rightly guessed! The new financial year is about to begin.

The extra push for businesses and their teams during the last few weeks of the financial year is nothing new. It’s the same every year. If you are a business using Tally Prime, you can end the financial year with little drama as possible and be ready to welcome the new financial year.

With this in mind, we have put together different ways to be ready for the next financial year using Tally Prime.

You may do all that is possible to close your books on the last day of the financial year, in reality, you will have spillover, or certain activities can only be carried out after the closure of the financial year.

While you got all the time to do that, what’s important here is to move to the new financial year and start the books from the 1st day of the new financial year. With Tally, moving into the new financial year is as simple as changing the date.

| How to Prepare your Business for Audit Trail (Edit Log) Rule? | Best E-Invoicing Software Solution for Businesses in India |

To change the current period, Go to Gateway of Tally> click F2: Period And enter the dates.

This way you can:

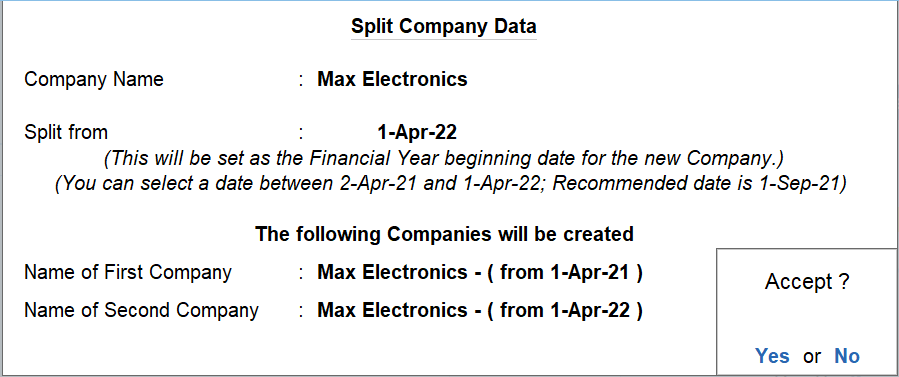

If you choose to separate your previous financial year into a different company, split company data will be helpful. Ideally, it is performed when the closure activities such as analysis, audits, all adjustments etc. in books of the previous financial year are completed.

To ensure the split activity is smooth, you need to perform the data verification process before splitting. This automatically detects possible errors in the data.

To split the company data, again click on 'Data' available in the top menu >Split>Split Data>Select Company.Once you’ve selected the company, enter the date in the Split Fromfield (Ideally, the new financial year date) and pressEnter.

When you split the data, the original data is retained, and two new companies with unique names and dates are created. You can rename the split company as required and save the original data in another location.

Split company data help you:

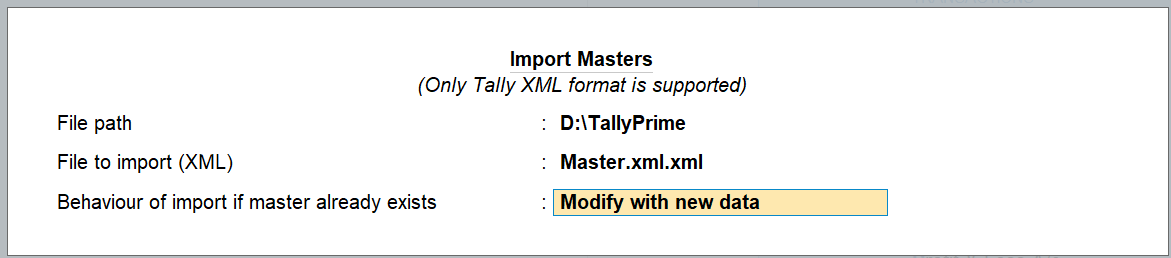

If you wish to create a new company, export the closing balances of the ledgers and stock items of the previous company, and import them as opening balances in the new company. This helps you to clean your data by removing redundant masters such as inactive ledgers, obsolete stock items etc.

To know in detail steps on company creation, read 'How to create a company in Tally Prime?

On completing the import process, you can compare the masters of both importing and exporting company from the statistics report. To view statistics, pressAlt + forGot To> Type and select statistics report from the list. If you wish to clean up the redundant or inactive ledgers or stock items, you can delete those.

At Tally, we come up with regular releases to make the product even more useful and provide an amazing experience for users. To make sure you’re not missing out on any important feature, it is important to always stay updated.

Tally Prime, our new business management simplifies the lives of business owners through simple to use business software, insightful reports, multi-tasking & much more. Yet to upgrade?

Already in Tally Prime but yet to upgrade to the latest release of Tally Prime? Here is how you can upgrade.

Click the 'F1:Help' option available in top menu >Upgrade>Select the latest release and press 'Enter' > Select 'U: Upgrade Now > Say 'Yes' to confirmation message > Again, say 'Yes' to restart the Tally Prime with administrator rights. Next, Tally Prime will restart in administrator mode to update the product.

Note:You need to have an active Tally Software Services (TSS) subscription to upgrade to the latest release.

Here is the list of new changes or policies related to GST and other statutes to be applicable from 1st April 2022

Know more on e-invoicing and audit trail