Till date, TDS was deducted only on the notified nature of payments. From 1st July,2021, businesses are required to deduct TDS on purchase of goods along with the current scope of TDS deduction applicable on notified nature of payment or expenditure. With the insertion of a new section ‘194Q’, the buyer is liable to deduct TDS on the goods purchases and remit it to the Government. Let’s understand the new section ‘194Q’ in more details.

Who should deduct TDS u/s 194Q?

You should deduct TDS under provision 194Q if the annual turnover of your business exceeds Rs 10 crore in the previous financial year.

What types of purchases you need to deduct TDS u/s 194Q?

You need to deduct TDS if you purchase goods worth more than Rs 50 lakhs from a single vendor in the same financial year. Apart from this, there are other conditions such as purchases should be from a resident and TDS has not been deducted under any other provisions of the Income Tax Act

What is the time or point at which TDS needs to be deducted?

TDS is required to be deducted at the time of credit of such sum to the account of the seller or at the time of payment whichever is earlier. In other words, if you are making payments to the party or while booking the purchase invoice, whichever is earlier, you have to deduct TDS and pay the remainder of the amount to the seller.

What is the rate of TDS?

You need to deduct TDS at 0.1% if the seller has a PAN, or at 5%, if the seller does not have a PAN.

Is TCS applicable if TDS is deductible by the buyer of the goods?

No. Section 194Q clarifies that if a buyer is liable to deduct TDS on a purchase transaction, the seller shall not collect TCS on the same transaction.

Details in a financial year | Use Case-1 | Use-case-2 | Use Case-3 | Use case-4 (PAN not Available) |

Turnover of Buyer | 15 Cr | 20 Cr | 8 Cr | 14 Cr |

Sale Value or consideration | 60 Lakhs | 8 Lakhs | 20 Lakhs | 70 Lakhs |

TDS deduction by buyer | Yes | No | NO | Yes |

Taxable value | 10 Lakhs | -- | -- | 20 Lakhs |

Rate of TDS | 0.1% | -- | -- | 5% |

*Taxable value refers to the value more than 50 lakhs i.e., the remaining amount of purchase after 50 lakhs. In cases where the buyer is not eligible to deduct TDS, the seller can collect tax on meeting threshold criteria.

For ease of recording TDS on purchases u/s 194Q in Tally Prime, follow the steps mentioned below. To know step-by-step by details to configure and recording translations, please readRecord TDS on Purchase of Goods (Under Section 194Q)

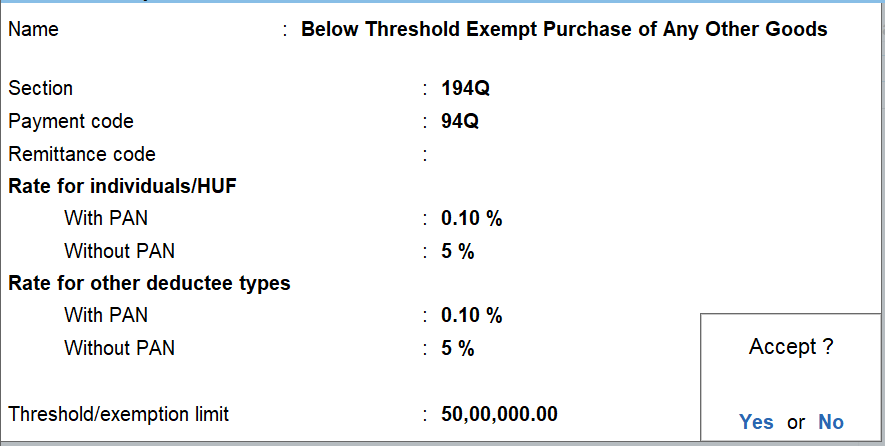

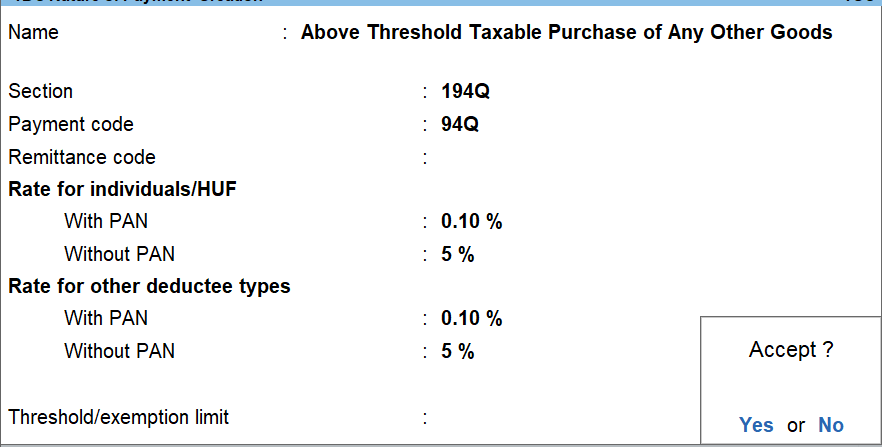

Create two ‘TDS Nature of Payments’ and configure one above the Threshold Limit (of Rs 50 lakhs) and one below the limit as shown in the images below. You can name the nature of payment accordingly for easy identification. Also, mention the rate as 0.10% with PAN and 5% in case of without PAN.

To create, navigate from Gateway of Tally > Create > type or select TDS Nature of Payments. Alternatively, press Alt+G (Go To) > Create Master > type or select TDS Nature of Payments.

Configure the purchase ledger and GST ledgers to ensure that both GST and TDS is applicable, and set the TDS Nature of Payment to ‘Any’.

While recording the purchase transaction, you have to select the relevant nature of payment in the ‘TDS Nature of Payment’ details sub-screen.

ReadRecord TDS on Purchase of Goods (Under Section 194Q)to know more on managing advance TDS payment, adjust TDS in purchase as per advance payment, purchase return/cancellation and TDS exemption for government-listed seller